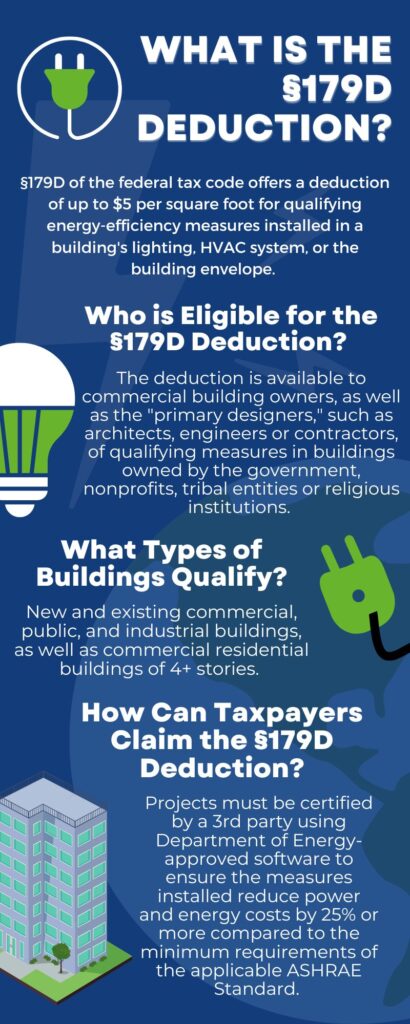

From utilities to taxes to maintenance, owning a commercial building carries numerous costs. Fortunately, the federal tax code features several incentives to help offset these costs, including the §179D deduction. Created under the Energy Policy Act (EPAct) of 2005 with a goal of reducing energy consumption in buildings across the U.S., the deduction is now worth up to $5 per square foot following enactment of the Inflation Reduction Act of 2022. This represents a significant increase from the previous amount of $1.80 per square foot. The §179D deduction, which has been a permanent part of the tax code since 2021, is available for qualifying improvements made to a building’s interior lighting systems, HVAC and hot water systems, and the building envelope.

features several incentives to help offset these costs, including the §179D deduction. Created under the Energy Policy Act (EPAct) of 2005 with a goal of reducing energy consumption in buildings across the U.S., the deduction is now worth up to $5 per square foot following enactment of the Inflation Reduction Act of 2022. This represents a significant increase from the previous amount of $1.80 per square foot. The §179D deduction, which has been a permanent part of the tax code since 2021, is available for qualifying improvements made to a building’s interior lighting systems, HVAC and hot water systems, and the building envelope.

Who is Eligible for the §179D Deduction?

Typically, the §179D deduction is claimed by building owners who install qualifying energy-efficiency measures. However, in the case of buildings owned by local, state, or federal government entities or nonprofit organizations, the deduction may be allocated to the primary designers—such as the architects, engineers, or contractors—of the qualifying measures.

What Types of Buildings May Qualify?

Installations in new or existing commercial, industrial, or public buildings may qualify for the deduction, as well as commercial residential buildings of four or more stories.

How Can Taxpayers Claim the §179D Deduction?

The §179D deduction is typically claimed in the year the qualifying measures entered service, but may be taken retroactively in certain circumstances.

Taxpayers seeking to claim the deduction must have their projects certified by a third party using Department of Energy-approved software. This process must confirm that the measures installed reduce energy and power costs by a total of 50% or more when all three building systems (lighting, HVAC, and envelope) are being considered compared to a building that meets the minimum requirements set by the applicable ASHRAE 90.1 Standard. For projects completed in 2021 or thereafter, this Standard is whichever one was in effect as of two years before construction began—currently, ASHRAE 90.1-2019. Taxpayers should be aware that ASHRAE 90.1-2019 is significantly more stringent than the one that was in effect prior to 2021.

When claiming the deduction, taxpayers may be asked to provide their tax professionals with documentation including the following:

- Project name and address

- Building systems to be studied

- Total square footage of space where the energy-efficiency measures have been implemented

- Building usage

- Project cost

- Date the building was placed in service

The §179D certification process also generally involves an onsite inspection by a licensed engineer or contractor.

While the process of claiming the §179D deduction involves several steps, the financial benefits may be substantial. As a qualified third-party §179D certification firm with a unique combination of tax and engineering expertise, Capital Review Group has helped numerous clients receive five-, six- or even seven-figure tax savings through this powerful deduction alone. To learn more or request a consultation, contact us today!